Book-keeping, tax returns, payroll, year end accounts, Directors Report and Financial Statements. Accounting can sometimes be a bit of a jungle and that’s why we’re here to help you tame those beasts. Don’t loose time, sleep or money wrestling with problems that go beyond your skill set, let us help you while you concentrate on growing your business.

Foundation can relieve you and your staff of the tasks associated with book-keeping. We work with you in order to understand your business and then tailor our approach to meet your requirements in order to provide exactly the service you need. We can:

- Input purchase and sales invoice data.

- Reconcile bank accounts.

- Calculate and file VAT returns.

- Monthly Management Reports

Foundation provides year end accounts for sole-traders, partnerships and limited companies. This will form the basis of your self-assessment tax return. We also prepare returns for CIS subcontractors and apply for refunds. We can:

- Produce limited company statutory accounts.

- File accounts with HM Revenue & Customs and Companies House.

- File CT600 Corporation Tax Returns.

- Apply for CIS refunds.

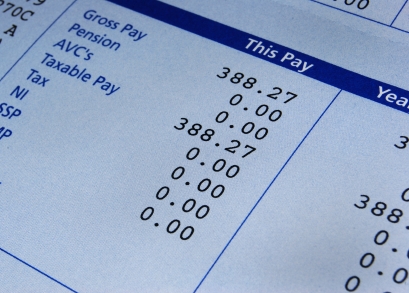

For small companies with one or more employees running a payroll is a necessity. It can be time consuming and costly if statutory deadlines are not met. Foundation can run a weekly or monthly payroll for you for a sensible monthly fee. The service includes:

- Customised payslips which can be sent directly to the employee.

- Administration of PAYE and National Insurance, SSP, SMP etc.

- Issuing of P60 and P45s to employees.

- Administration of pension schemes.

- Provide summaries of staff costs for the period.

- Monthly Real Time Information reports sent directly to HMRC.

Automatic Enrolment

A new law means that every employer must automatically enrol workers into a workplace pension scheme if they:

- Are aged between 22 and State Pension age

- Earn more than £10,000 a year

- Work in the UK

This is called ‘automatic enrolment’.

You can find more information from the Pension Regulator or contact us for any support you may need.

This is not always as straight forward as it seems. Fines may be incurred for late filing or returns not being completed correctly. Foundation can save you time and worry by handling this for you. We will:

- Complete your tax return.

- Calculate your final tax liability.

- File the return on-line on your behalf.

- Advise you on the amounts to be paid and when they are due.

If you are just about to start up a new limited company Foundation can arrange this for you along with advising on appropriate software for your needs and general administration of your books and records. We will advise you on time scales for filing statutory returns and accounts, payment of National Insurance and Tax. We can:

- Set up your new company and register you with Companies House.

- Register you for VAT.

- Register you for PAYE.

- Organise and implement software to maintain your records.

- SAGE Training

We provide a bespoke service to our client be they a sole trader or small company. Our aim is to give the kind of reliable, efficient and cost-effective service we ourselves would expect to receive. Call us on 01622 298148.

Book-keeping | Preparation of accounts for the Self-employed | Ltd Company Statutory Accounts | Filing of Corporation Tax Returns | Filing of Individual Self-Assessment Tax Returns | CIS Subcontractors – Accounts prepared and tax refunds applied for | New company start-ups | Preparation of VAT Returns | Payroll Service | Tax planning and advice | Sage Software Training | Company Secretarial | Wills & Trusts | Lasting Powers of Attorney | Inheritance Trusts | Property Trusts | Probate